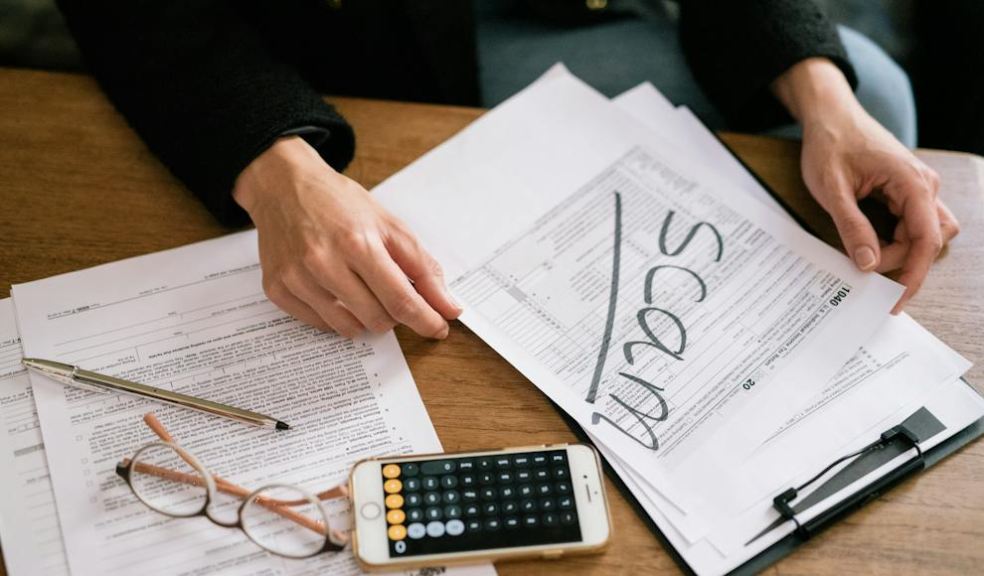

Navigating Investment Scams: UK Guidelines Explained

Investment scams are a growing problem in the UK, with more and more people falling victim to fraudulent schemes each year. These scams can take many different forms, from fake investment opportunities to phishing scams designed to steal personal information. It is important to reach out for legal help at https://www.kellerpostman-investmentfraud-misselling.co.uk/ and for individuals to be aware of the risks and take steps to protect themselves.

The Financial Conduct Authority (FCA) is the regulatory body responsible for overseeing financial markets in the UK. The FCA has launched a campaign called ScamSmart, which is designed to help individuals avoid investment and pension scams. The campaign provides information on how to spot the signs of a scam, what to do if you suspect you have been targeted, and how to protect yourself from future scams.

To protect yourself from investment scams, it is important to be aware of the warning signs. These can include unsolicited phone calls or emails, promises of high returns with little or no risk, and pressure to invest quickly. If you suspect that you have been targeted by a scam, it is important to report it to the authorities and seek advice from a reputable financial advisor. By staying informed and taking steps to protect yourself, you can reduce your risk of falling victim to investment scams.

Recognising Investment Scams

https://www.youtube.com/watch?v=Ls2DCdfwjF0&embed=true

Investment scams come in many shapes and sizes, and fraudsters are always coming up with new ways to scam people out of their hard-earned money. It's important to be able to recognise the warning signs and red flags of investment scams to avoid being caught out.

Common Types of Investment Scams

There are several common types of investment scams that people should be aware of, including land banking, wine and diamond investments, graphene, hotels, parking, storage, student accommodation, and cryptocurrencies such as Bitcoin.

Warning Signs and Red Flags

Investment scams often promise high returns with little or no risk, which is a major warning sign. If an investment opportunity seems too good to be true, it probably is. Other red flags include pressure to invest quickly, vague or complex jargon, and promises of exclusive or secret investment opportunities.

Methods of Contact and Persuasion

Fraudsters may use a variety of methods to contact potential victims, including cold calls, emails, texts, and social media. They may also use fake testimonials and other tactics to try and gain the trust of their victims. It's important to be wary of unsolicited investment offers and to do your own research before investing in anything.

If you suspect that you have been targeted by an investment scam, you can check the FCA's warning list for known scams and contact details for reporting suspected scams. Remember, if an investment opportunity seems too good to be true, it probably is.

Conclusion: Protecting Yourself and Reporting Scams

Investment fraud is a serious issue that can cause significant financial loss. To avoid falling victim to investment scams, it is crucial to take preventive measures, know what action to take if you suspect a scam, and understand how to recover from investment fraud.

Preventative Measures

Protecting yourself from investment scams involves being vigilant and informed. Here are some measures you can take:

- Seek independent financial advice before making any investment decisions.

- Check the Financial Services Register to ensure that the firm or individual you are dealing with is authorized to provide investment services.

- Be wary of unsolicited calls, emails, or texts offering investment opportunities, bonuses, or discounts.

- Be cautious of investments in metals, energy, land, or gold, particularly if they are advertised as a "sure thing" or "risk-free."

- Avoid pyramid schemes that require you to recruit new investors to make money.

- Research the investment thoroughly, including the materials provided, before investing.

Action to Take if You Suspect a Scam

If you suspect that you have been targeted by an investment scam, take the following steps:

- Report it to the Financial Conduct Authority (FCA) or the ScamSmart website.

- Contact Action Fraud to report the scam and get advice on what to do next.

- Check the FCA Warning List to see if the investment opportunity is a known scam.

- Do not send any more money to the scammer.

- Keep records of any communication you have had with the scammer.

Recovering from Investment Fraud

If you have fallen victim to an investment scam, here are some steps you can take to recover:

- Contact your bank or credit card provider to see if you can get your money back.

- Report the scam to the police and provide any evidence you have.

- Seek legal advice to see if you can take legal action against the scammer.

- Consider seeking support from a victim support group.

Overall, it is essential to be cautious when investing and to seek independent financial advice. If you suspect a scam, report it immediately to the relevant authorities. By taking these steps, you can protect yourself and reduce the risk of falling victim to investment fraud.